1. 示例代码1

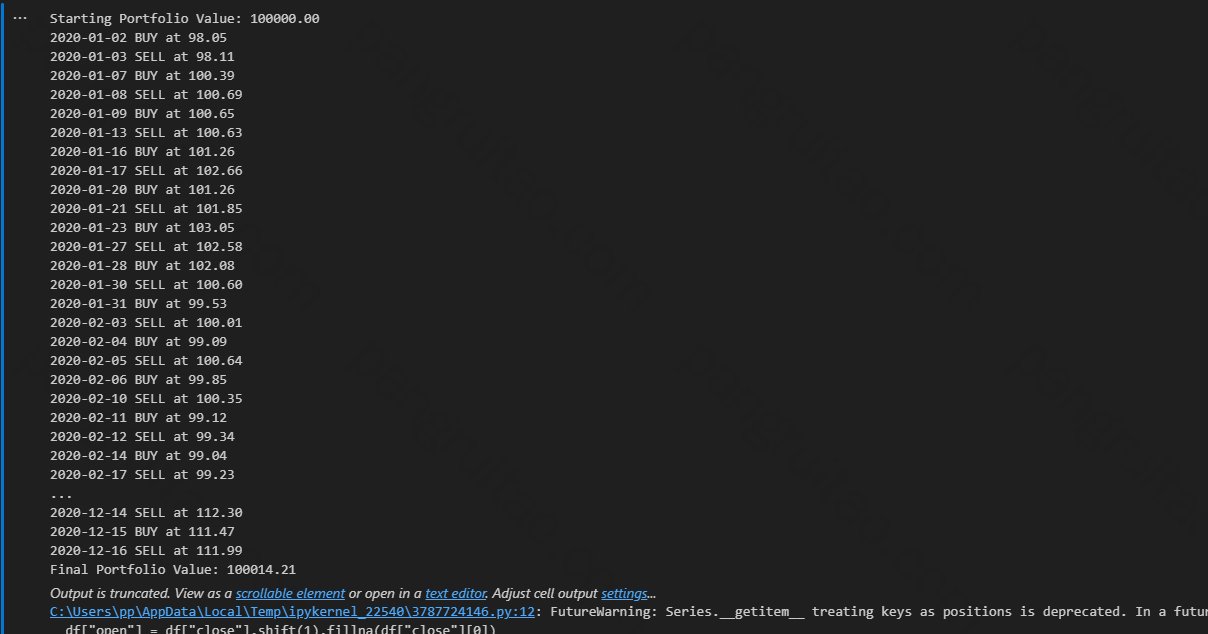

backtrader的示例代码,如果标的价格昨天降了则买,昨天涨了则卖,标的价格随机生成,模拟一年的数据

import pandas as pd

import numpy as np

import backtrader as bt

# 生成一年的随机价格数据(交易日)

dates = pd.date_range(start="2020-01-01", periods=252, freq="B") # 252 个交易日

# 随机价格生成:起始价 100,然后累积正态分布波动

price = 100 + np.random.randn(len(dates)).cumsum()

# 构造 DataFrame

df = pd.DataFrame(index=dates)

df["close"] = price

df["open"] = df["close"].shift(1).fillna(df["close"][0])

# high/low 加入小幅随机波动

df["high"] = df[["open", "close"]].max(axis=1) * (1 + np.random.rand(len(df)) * 0.01)

df["low"] = df[["open", "close"]].min(axis=1) * (1 - np.random.rand(len(df)) * 0.01)

# 随机成交量

np.random.seed(42)

df["volume"] = np.random.randint(100, 1000, size=len(df))

# 定义策略:如果昨天收盘价比前天低则买入,昨天收盘价比前天高则卖出

class BuyOnDownSellOnUp(bt.Strategy):

def next(self):

# 确保至少有前一天数据

if len(self.data.close) < 2:

return

today_close = self.data.close[0]

yesterday_close = self.data.close[-1]

# 下跌买入

if today_close < yesterday_close:

if not self.position:

self.buy(size=1)

print(f"{self.data.datetime.date(0)} BUY at {today_close:.2f}")

# 上涨卖出

elif today_close > yesterday_close:

if self.position:

self.sell(size=1)

print(f"{self.data.datetime.date(0)} SELL at {today_close:.2f}")

if __name__ == "__main__":

cerebro = bt.Cerebro()

# 加载数据

datafeed = bt.feeds.PandasData(dataname=df)

cerebro.adddata(datafeed)

# 添加策略

cerebro.addstrategy(BuyOnDownSellOnUp)

# 设置初始资金

cerebro.broker.setcash(100000.0)

# 运行回测

print("Starting Portfolio Value: %.2f" % cerebro.broker.getvalue())

cerebro.run()

print("Final Portfolio Value: %.2f" % cerebro.broker.getvalue())运行能看到所有交易行为以及最后的资产情况

2. 示例代码2

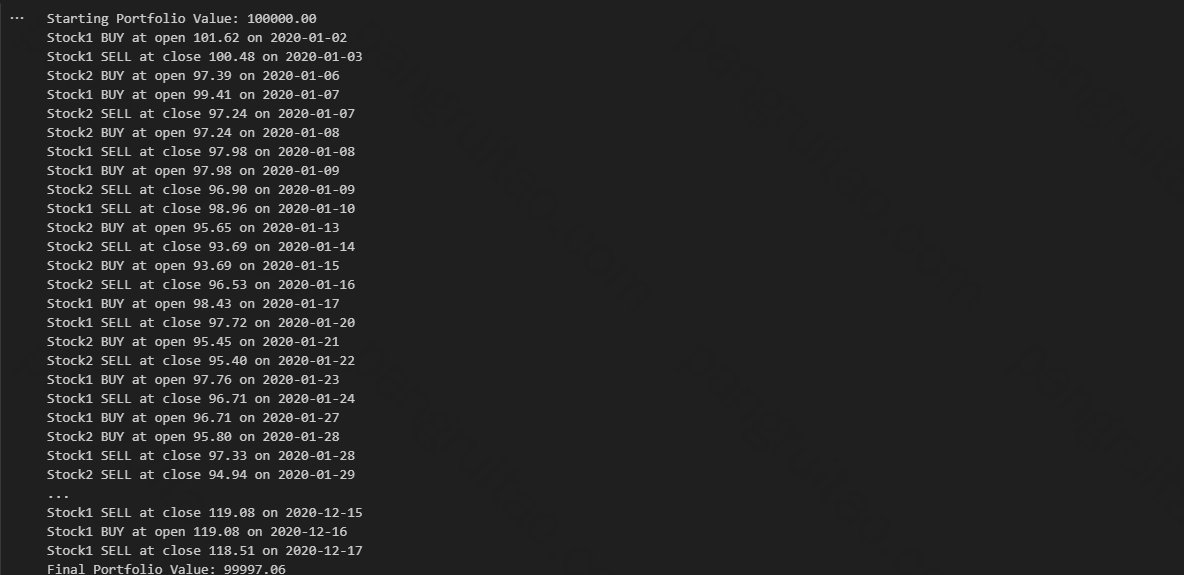

再加入一只股票(也随机),每天开盘买入昨天下跌幅度最大的一支股票(如果都没跌则不买),并且在收盘进行清仓

import pandas as pd

import numpy as np

import backtrader as bt

# 生成一年的随机价格数据(交易日)

dates = pd.date_range(start="2020-01-01", periods=252, freq="B")

# 辅助函数:根据随机种子生成单只股票的OHLCV数据

def make_df(seed):

np.random.seed(seed)

price = 100 + np.random.randn(len(dates)).cumsum()

df = pd.DataFrame(index=dates)

df["close"] = price

df["open"] = df["close"].shift(1).fillna(df["close"].iloc[0])

df["high"] = df[["open", "close"]].max(axis=1) * (

1 + np.random.rand(len(df)) * 0.01

)

df["low"] = df[["open", "close"]].min(axis=1) * (1 - np.random.rand(len(df)) * 0.01)

df["volume"] = np.random.randint(100, 1000, size=len(df))

return df

# 生成两只随机股票数据

df1 = make_df(seed=1)

df2 = make_df(seed=2)

# 策略:每天开盘买入昨日跌幅最大的一只(如果有跌幅),收盘时清仓

class LargestDropStrategy(bt.Strategy):

def next(self):

# 需要至少两天数据

if len(self.datas[0].close) < 2:

return

# 计算每只股票的昨日跌幅(正值表示下跌幅度)

drops = []

for data in self.datas:

y_close = data.close[-1]

d2_close = data.close[-2]

diff = y_close - d2_close

drops.append(-diff if diff < 0 else 0)

max_drop = max(drops)

# 如果有跌幅,则选跌幅最大的一只并在开盘价买入

if max_drop > 0:

idx = drops.index(max_drop)

best_data = self.datas[idx]

open_price = best_data.open[0]

if self.getposition(best_data).size == 0:

self.buy(data=best_data, size=1)

print(

f"{best_data._name} BUY at open {open_price:.2f} on {best_data.datetime.date(0)}"

)

# 收盘时清仓

for data in self.datas:

pos = self.getposition(data).size

if pos > 0:

close_price = data.close[0]

self.sell(data=data, size=pos)

print(

f"{data._name} SELL at close {close_price:.2f} on {data.datetime.date(0)}"

)

if __name__ == "__main__":

cerebro = bt.Cerebro()

# 将两只股票数据加入回测

data1 = bt.feeds.PandasData(dataname=df1, name="Stock1")

data2 = bt.feeds.PandasData(dataname=df2, name="Stock2")

cerebro.adddata(data1)

cerebro.adddata(data2)

cerebro.addstrategy(LargestDropStrategy)

cerebro.broker.setcash(100000.0)

print("Starting Portfolio Value: %.2f" % cerebro.broker.getvalue())

cerebro.run()

print("Final Portfolio Value: %.2f" % cerebro.broker.getvalue())

3. 示例代码3

载入自己的数据df:

- 从2012开始的AH股数据

继续用每天开盘买入昨天下跌幅度最大的一支股票(如果都没跌则不买),并且在收盘进行清仓的逻辑

不过需要额外进行数据处理

- 考虑缺失值:包含还未上市股票和偶尔停牌情况

- 处理方式向前填入缺失值,同时打上标记。在进行策略时忽略当日的缺失股

import pandas as pd

import backtrader as bt

from datetime import datetime

# ———————————— 0. 读取你的 AH 数据 ————————————

# ahp = pd.read_csv("你的 ahp.csv", dtype={"ts_code_A": str, "ts_code_H": str})

# 这里假设 ahp 是包含 A 股和 H 股调整后 OHLCV 的 DataFrame

# ———————————— 1. 预处理日期列 ————————————

# 将交易日从整数/字符串格式转换为 pandas 的 datetime 类型,方便后续索引和处理

ahp["trade_date"] = pd.to_datetime(

ahp["trade_date"].astype(str), # 原始格式如 20191122

format="%Y%m%d", # 指定日期格式

)

# 按日期排序,确保数据按时间顺序排列

ahp.sort_values("trade_date", inplace=True)

# 计算全期主交易日历:从最早交易日到最晚交易日,按工作日(Business Day)频率生成日期索引

earliest = ahp["trade_date"].min()

latest = ahp["trade_date"].max()

all_dates = pd.date_range(start=earliest, end=latest, freq="B") # B 代表工作日

# ———————————— 2. 定义自有数据格式(CustomPandasData) ————————————

# 扩展 bt.feeds.PandasData,新增一个 "listed" 字段,用于标识当日是否有真实交易(未上市/停牌)

class CustomPandasData(bt.feeds.PandasData):

# 定义新的 line

lines = ("listed",)

# params 用于映射 feed 中的列名到 backtrader 内部属性

params = (

("datetime", None), # 使用 DataFrame 的 index 作为日期时间

("open", "open"), # open 列

("high", "high"), # high 列

("low", "low"), # low 列

("close", "close"), # close 列

("volume", "volume"), # volume 列

("openinterest", None), # 不使用 openinterest

("listed", "listed"), # 新增 listed 列

)

# ———————————— 3. 策略逻辑:LargestDropStrategy ————————————

# 策略思路:每个 bar 计算所有股票的单日跌幅,择最大跌幅标的买入,收盘清仓

class LargestDropStrategy(bt.Strategy):

def notify_order(self, order):

"""

订单状态通知

order.status:

- Submitted/Accepted: 已提交或被接受

- Completed: 已成交

- Canceled/Margin/Rejected: 取消/保证金不足/拒单

"""

# 仅在订单完成或失败时打印日志

if order.status in [order.Submitted, order.Accepted]:

return # 尚未决策成交

if order.status == order.Completed:

# 成交后打印买卖类型、标的名称、成交价、成交量

action = "BUY" if order.isbuy() else "SELL"

print(

f"{action} EXECUTED: {order.data._name},"

f" Price: {order.executed.price:.2f},"

f" Size: {order.executed.size}"

)

else:

# 其他失败情况打印提示

print(

f"Order {order.getordername()} on {order.data._name} "

f"Canceled/Margin/Rejected"

)

def notify_trade(self, trade):

"""

成交明细通知,当一笔交易(开仓+平仓)完全结束后触发

trade.pnl: 毛利润(不含佣金)

trade.pnlcomm: 扣除佣金滑点后的净利润

"""

if trade.isclosed:

print(

f"TRADE CLOSED: {trade.data._name},"

f" Gross PnL: {trade.pnl:.2f},"

f" Net PnL: {trade.pnlcomm:.2f}"

)

def next(self):

"""

核心交易逻辑:

1. 跳过数据不足或无效 bar

2. 计算当日跌幅列表

3. 选最大跌幅标的买入

4. 收盘统一平仓

"""

# 至少需要两根 bar 才能计算昨日收盘价

if len(self.datas[0].close) < 2:

return

drops = [] # 存储每个标的的跌幅

for data in self.datas:

# 1) 如果未上市或停牌,则跌幅记为 0 并跳过

if data.listed[0] == 0 or data.volume[0] == 0:

drops.append(0)

continue

# 2) 获取昨日和今日收盘价

prev_close = data.close[-2]

curr_close = data.close[-1]

# 若价格无效(<=0 或 NaN),同样跳过

if prev_close <= 0 or curr_close <= 0:

drops.append(0)

continue

# 3) 计算跌幅:只有跌才计负值(方便取最大跌幅)

diff = curr_close - prev_close

drops.append(-diff if diff < 0 else 0)

# 如果存在正的跌幅(即真正下跌),择最大值的标的买入

max_drop = max(drops)

if max_drop > 0:

idx = drops.index(max_drop)

target = self.datas[idx]

open_price = target.open[0]

# 确保开盘价有效且当前未持仓

if open_price > 0 and self.getposition(target).size == 0:

print(

f"BUY SIGNAL: {target._name} at Open {open_price:.2f} on "

f"{target.datetime.date(0)}"

)

self.buy(data=target, size=1)

# 收盘时,对所有持仓进行平仓

for data in self.datas:

pos_size = self.getposition(data).size

if pos_size > 0:

# 只在有行情(listed==1, vol>0)日平仓也可按需添加判断

close_price = data.close[0]

print(

f"SELL SIGNAL: {data._name} at Close {close_price:.2f} on "

f"{data.datetime.date(0)}"

)

self.sell(data=data, size=pos_size)

# ———————————— 4. 主函数:喂入数据、运行回测 ————————————

if __name__ == "__main__":

# 1) 初始化 Cerebro 引擎

cerebro = bt.Cerebro()

# 2) 设置初始资金

cerebro.broker.setcash(1_000_000.0)

# —— 4.1 导入 A 股数据 ——

for code in ahp["ts_code_A"].unique():

df = ahp[ahp["ts_code_A"] == code].copy()

df.set_index("trade_date", inplace=True)

# 重命名列并选取需要的 OHLCV

df_feed = (

df[

["open_adj_A", "high_adj_A", "low_adj_A", "close_adj_A", "vol_A"]

].rename(

columns={

"open_adj_A": "open",

"high_adj_A": "high",

"low_adj_A": "low",

"close_adj_A": "close",

"vol_A": "volume",

}

)

# 按主交易日历补全所有日期

.reindex(all_dates)

)

# listed: 真实交易日为 1,停牌/未上市为 0

df_feed["listed"] = df_feed["close"].notna().astype(int)

# 对 OHLC 做前向填充,停牌日价格维持前一有效价,上市前置 0

df_feed[["open", "high", "low", "close"]] = (

df_feed[["open", "high", "low", "close"]].ffill().fillna(0.0)

)

# volume 缺失或停牌置 0

df_feed["volume"] = df_feed["volume"].fillna(0)

# 获取标的名称(或 ts_code)作为数据源名称

name = df.get("name", pd.Series([code])).iat[0]

data_feed = CustomPandasData(dataname=df_feed, name=f"{name}_A")

cerebro.adddata(data_feed)

# —— 4.2 导入 H 股数据 ——

for code in ahp["ts_code_H"].unique():

df = ahp[ahp["ts_code_H"] == code].copy()

df.set_index("trade_date", inplace=True)

df_feed = (

df[["open_adj_H", "high_adj_H", "low_adj_H", "close_adj_H", "vol_H"]]

.rename(

columns={

"open_adj_H": "open",

"high_adj_H": "high",

"low_adj_H": "low",

"close_adj_H": "close",

"vol_H": "volume",

}

)

.reindex(all_dates)

)

df_feed["listed"] = df_feed["close"].notna().astype(int)

df_feed[["open", "high", "low", "close"]] = (

df_feed[["open", "high", "low", "close"]].ffill().fillna(0.0)

)

df_feed["volume"] = df_feed["volume"].fillna(0)

name = df.get("name", pd.Series([code])).iat[0]

data_feed = CustomPandasData(dataname=df_feed, name=f"{name}_H")

cerebro.adddata(data_feed)

# 5) 添加策略并运行

cerebro.addstrategy(LargestDropStrategy)

print(f"Starting Portfolio Value: {cerebro.broker.getvalue():.2f}")

cerebro.run()

print(f"Final Portfolio Value: {cerebro.broker.getvalue():.2f}")运行情况: